A STR is a report of possible money laundering involving transactions between persons or companies.

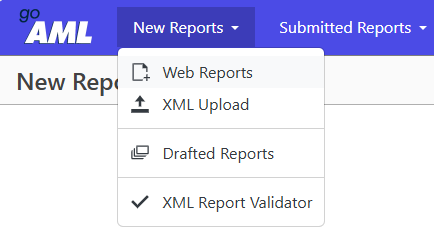

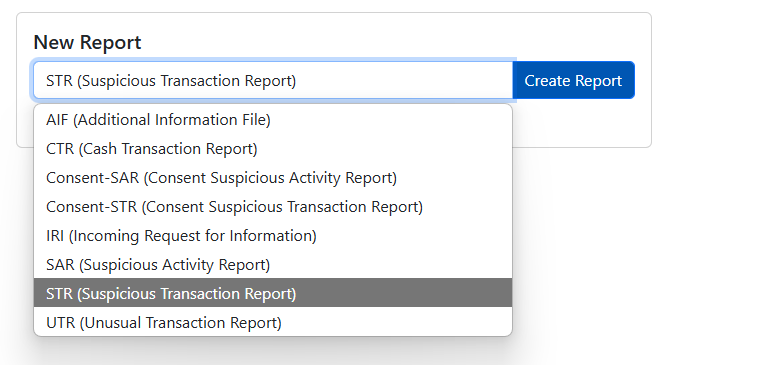

A STR report is created through the web form on the GoAML website. Press New Report in the menu and then select Web Report.

Then select Suspicious Transaction Report (STR) and follow the steps below

HOW TO COMPLETE A STR REPORT

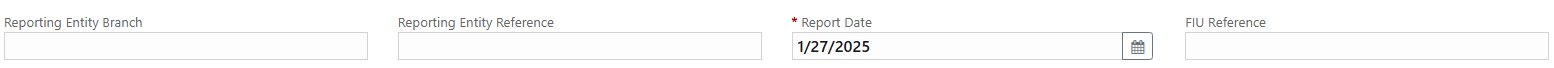

The reporting party is directed to enter the relevant reporting entity branch, the reporting party’s internal case number for a report, the reference date and the FIU reference.

What should I enter in the various fields?

- Reporting Entity Branch – The reporting entity’s branch

- Reporting Entity Reference – The reporting entity’s internal case number

- Report Date (Obligatory) – The date the report is sent to FIA

- FIU Reference – Can be used to identify previously submitted report by the person obliged to report regarding the same customer relationship or otherwise related to the current report

Thereafter, the grounds for suspicion should be filled in, in the ‘Reason for Reporting’ box.

An adequate and detailed basis for suspicion is essential for a good report.

It is important that reports to FIA contain all relevant information. This means, for example, that the accounts, persons and companies involved must, as far as possible, be identified and described in the reason for suspicion.

The reason for suspicion must consist of a minimum guidance notes mandatory fields, otherwise the report will be rejected upon submission to the FIA.

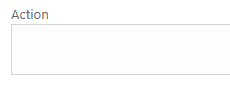

When the reason for suspicion has been filled in, the reporting party will see the Action field.

The FIA recommends that the reporting party states which specific actions the reporting party has taken in relation to the customer to whom the suspicion relates. It could be, for example, that the reporting party has stopped a transaction, terminated a customer or the like.

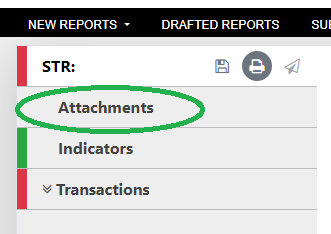

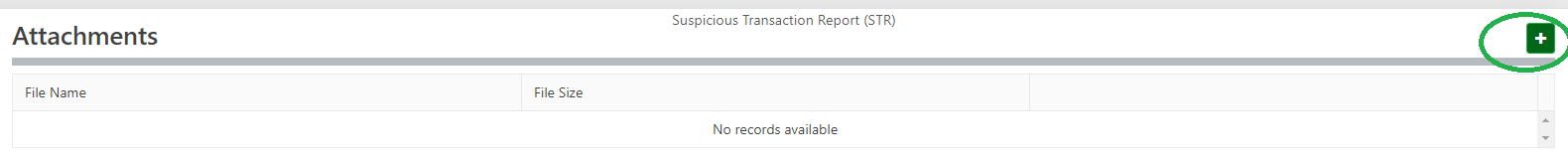

After this, the next step is to go to Attachments. This is obgliatory.

The reporting party is then directed to the field below, where attachments can be attached. Attachments are added by clicking on the green button in the right corner.

The reporting party may choose to attach attachments to reports. The appendices can, for example, consist of the reporting party’s own analysis of a suspected person or company, surveillance material from an ATM, an ID card that identifies the person concerned, work contracts, email correspondence or other relevant material that can support the suspicion.

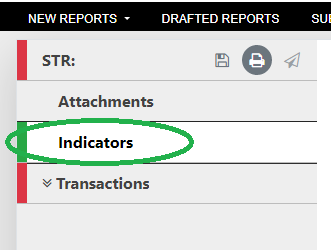

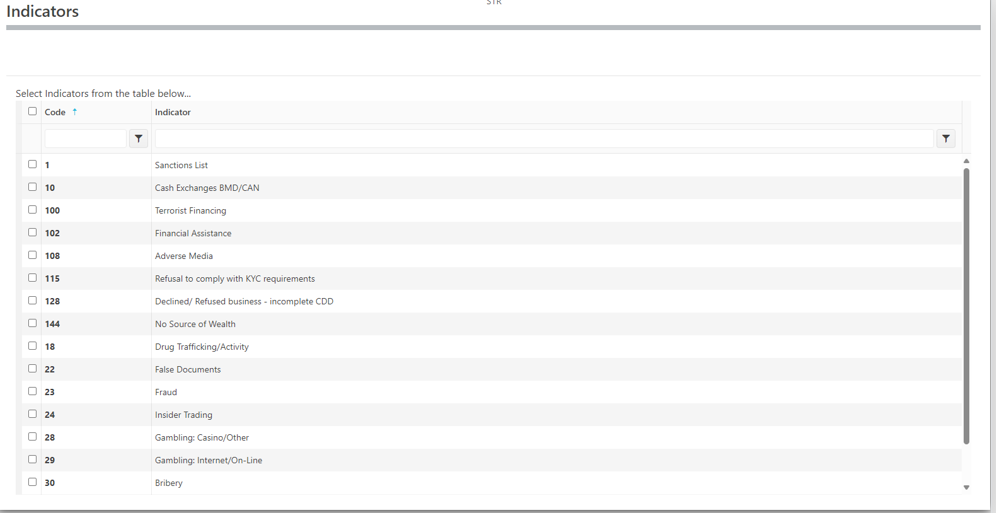

After this, the next step is to click on ‘Indicators’, so that the right indicator codes that are relevant to the report can be selected.

The next step is to select the indicator codes that fit the report.

Which Indicator code should I chose?

FIA recommends that the reporting party selects the indicator code(s) that best suit the report.

If the reporting party does not select an indicator, the report is automatically rejected by goAML.

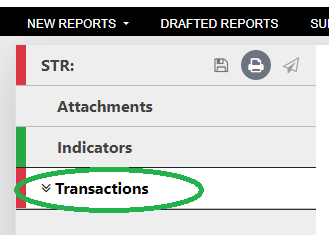

When the reporting party has selected one or more indicator codes for a STR notification, then click on to Transactions.

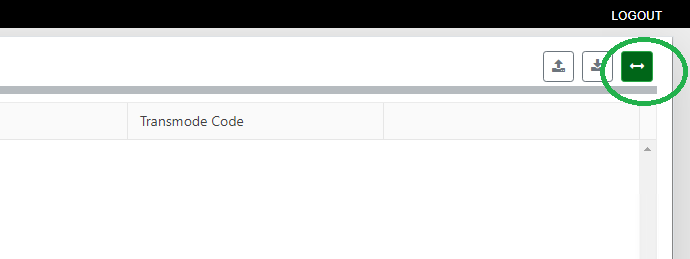

The reporting party is now directed to complete Transactions. The reporting party must click on the green icon in the upper right corner to fill in information about a transaction.

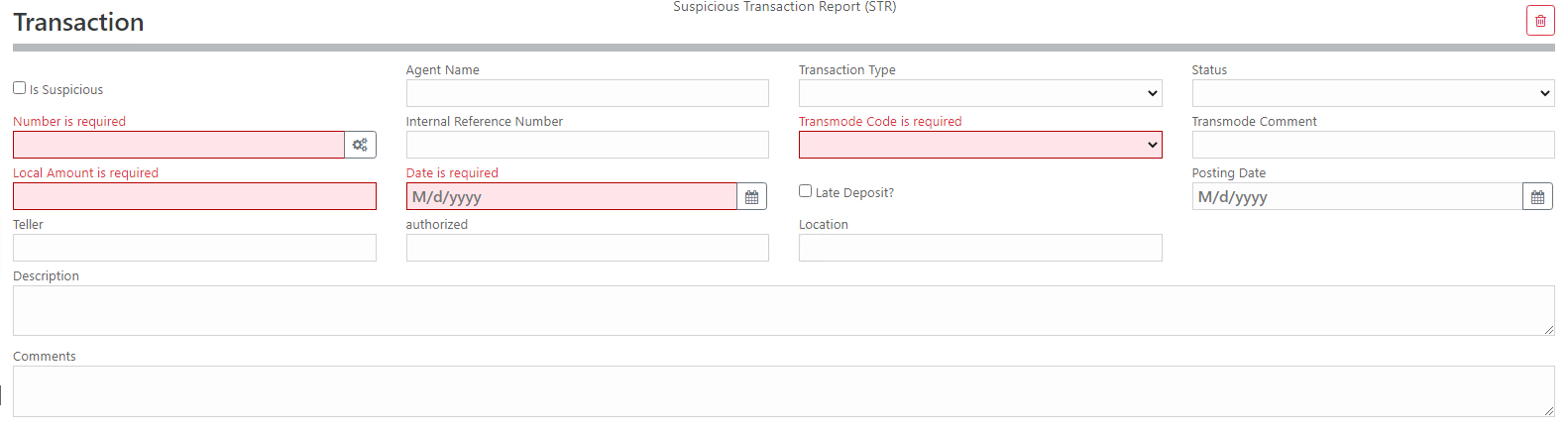

The following will then appear:

What should I enter in the various fields?

- Agent Name – Agent name of the reporting agent, in the case of remittance agencies, when the report is made by the main service provider

- Transaction Type – The type of transaction in question

- Status – The reporting party can choose here what the status of the transaction is

- Number (Obligatory) – Auto Generated Transaction ID (click on the icon for auto generation)

- Interal Reference Number – The reporting party’s internal reference number of the transaction

- Transmode Code (Obligatory) – The type of transaction in the form of, for example, bank transfer, cash deposit, currency exchange, etc.

- Transmode Comment – The reporting party’s comment on a transaction type that is not explained in any other way in the other fields

- Local Amount (Obligatory) – The amount of the transaction in local currency

- Date (Obligatory) – Date of the transaction

- Posting Date – The day the transaction took place

- Location – For example, the location of the branch that has approved or observed a suspicious transaction or behavior

- Description – The field can be used to expand details regarding the transaction

- Comments – Any comments regarding the transaction can be inserted in this field

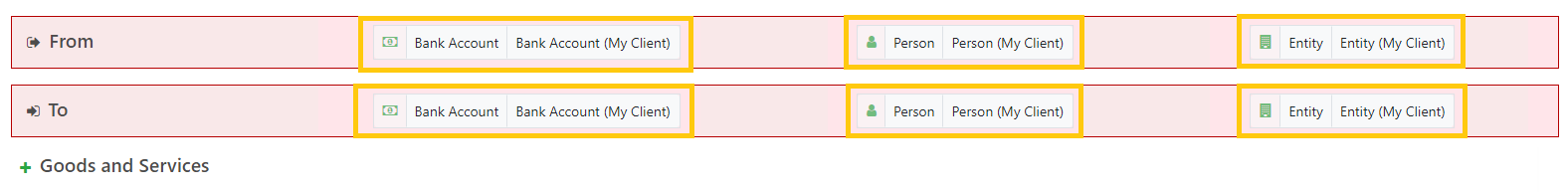

When the fields in “Transactions” have been filled in, persons, companies and/or bank accounts must be linked. Therefore, it must be stated in the “Transactions” fields under “From” and “To”, who the transaction is from and to whom the transaction is going. To this end, one of the parties in either “From” or “To” must be a customer of the reporting party who prepares the report, which is why “MyClient” must be selected in one of the categories.

“(MyClient)” – can be a bank account, person or company, and can be selected at both ends of a transaction.

Which category should I choose?

- From – The sending party of a transaction

- To – The receiving party of a transaction

- Bank Account – An account involved in suspicious transactions or suspicious financial behavior that is not a customer of the financial institution making the specific report

- Bank Account (MyClient) – An account involved in suspicious transactions or suspicious financial behavior that is a customer of the financial institution making the specific report

- Person – A person who carries out suspicious transactions or engages in suspicious financial behavior who is not a customer of the financial institution making the specific report

- Person (MyClient) – A person who carries out suspicious transactions or has suspicious financial behavior who is a customer of the financial institution making the specific report

- Entity – A company that carries out suspicious transactions or has suspicious financial behavior that is not a customer of the financial institution that makes the specific report

- Entity (MyClient) – A company that carries out suspicious transactions or has suspicious financial behavior that is a customer of the financial institution that makes the specific report

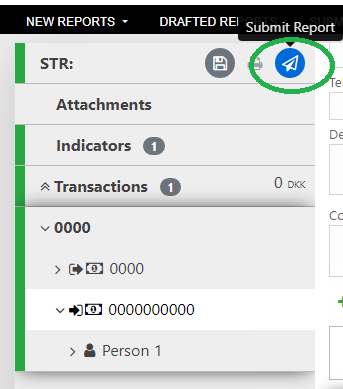

When the reporting party has completed the report and is ready to send it to FIA, all sections must be green, before you can click on the small paper airplane icon.

* Please save the report before sending if you wish to keep a copy of the report. You will not be able to save the report once it has been sent to the FIA