What type of report should I send ?

When reporting, you must choose the type of report that suits your grounds for suspicion and the information you have available.

If you do not have information about a transaction, complete a Suspicious Activity Report (SAR).

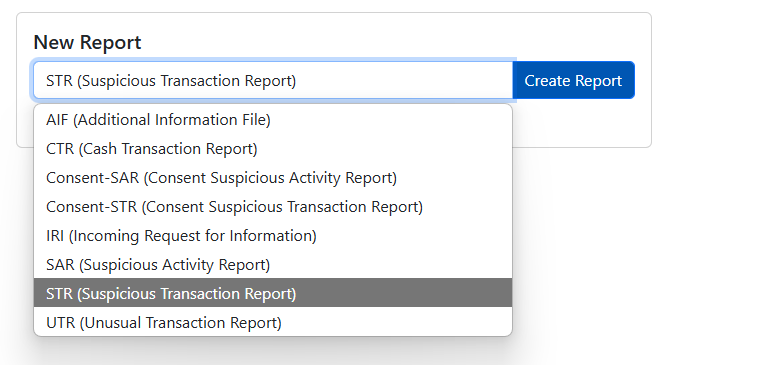

Select a report type

The relevant type of report is selected on the basis of information that the reporting party has in its possession.

The key difference between a STR report and a SAR report is the basis of suspicion. For a SAR report, the basis for suspicion is behavior and not a transaction, while the basis for a STR report is one or more transactions. To this end, transactions must be understood as all types of transactions.

Additional Information File (AIF)

This type of report is used when you have reported suspicious transactions and will add additional transactions to your original report. When reporting this type of report, the supplementary transactions are linked together with the transactions from the original notification. In this report, you must provide a Reference ID from the original report you reported. This type of report is also used to respond to Section 16 notices

Cash Transaction Report (CTR)

This type of report is used in relation to dealers in High Value Goods (DiHVG), A DIHVG who intends to accept such cash payments must register with the Supervisor of this sector, the Office of the Registrar of Companies, before accepting cash payments.

Whenever cash equal to or over the BMD $7,500 threshold is accepted by a DiHVG, that business must file a cash transaction report (CTR)

Consent Suspicious Activity Report (Consent-SAR)

This type of report is used in relation to seek consent that clearly sets out the specific pending action for which consent is desired (i.e. purchase of real property, contribution, distribution, and/or loan of funds, share issuance/redemption) accompanied by supporting documentation which should include adverse media.

Consent Suspicious Transaction Report (Consent-STR)

This type of report is used in relation to seek consent that clearly sets out the specific transaction for which consent is desired (i.e. purchase of real property, contribution, distribution, and/or loan of funds, share issuance/redemption) accompanied by supporting documentation which should include adverse media.

Incoming Request for Information (IRI)

This type of report is in relation to Requests for information received from and sent to local law enforcement and local regulatory agencies to assist with local and overseas cases/investigations.

Suspicious Activity Report (SAR)

A SAR details the identified suspect activity that does not currently contain any financial transactions. For example, declined business, dubious emails and requests, strange phone calls and the suspect comportment or associations of a subject or entity can be detailed in a SAR.

Suspicious Transaction Report (STR)

A STR details the identified suspect activity that involves a financial transaction. For example, unusual transactions that deviate from known client activity, unexplained large cash deposits, transactions which have no apparent lawful purpose and transactions to high-risk jurisdictions. Financial transactions are to be input into goAML to support the STR narrative along with the relevant supporting documentation. Please note when reporting this type of report, you must fill in the sender and receiver in the transaction, where at least 1 of the parties must be marked as (My Client).

Unusual Transaction Report (UTR)

UTR relates to all unusual (cash) transactions that might be suspicious. After examination, a UTR can be dismissed as unsuspicious or raised to an STR. The reporting institutions may add one or more file attachments or report a collection of one or more unusual transactions at the same time. The system treats a file with multiple unusual transactions as separate reports.